Executive Certificate Course in Financial Automation and Analytics

Transform Your Career with Professional Financial and Data Analytics Skills. In today's data-driven business world, finance professionals who can analyze numbers, interpret trends, and present insights are becoming indispensable. Learn to combine core finance knowledge with statistical analysis, Excel mastery, Power BI dashboards, and portfolio management, creating a skill set that opens doors to high-paying roles in corporate finance, investment analysis, and business intelligence through this comprehensive 6-month program designed by iHUB DivyaSampark, IIT Roorkee, and SkillArbitrage.

This course is designed for ambitious individuals who want to master the intersection of finance, accounting, and data analytics. In today's data-driven business world, finance professionals who can analyze numbers, interpret trends, and present insights are becoming indispensable. Companies don't just need accountants anymore; they need financial analysts who can forecast revenues, assess risks, build dashboards, and guide strategic decisions.

This course is built for aspiring finance professionals, business analysts, accountants, engineers, and career switchers who want to master the complete finance and data analytics stack, from understanding financial statements to building powerful data visualizations and managing investment portfolios. You'll learn to combine core finance knowledge with statistical analysis, Excel mastery, Power BI dashboards, and portfolio management, creating a skill set that opens doors to high-paying roles in corporate finance, investment analysis, and business intelligence.

Whether you're a B.Com student, MBA aspirant, working professional, engineer, or complete beginner, this program will show you how to become a data-savvy finance professional that modern businesses are actively seeking. You'll learn everything from basic accounting principles to advanced portfolio analysis, positioning yourself as a complete finance and analytics professional built for the modern economy.

This program transforms you into a complete finance and analytics professional who can:

✓ Analyze financial statements to spot risks and opportunities

✓ Build forecasting models that predict cash flows and revenues

✓ Create interactive dashboards that make complex data understandable

✓ Assess investment portfolios using modern portfolio theory

By course end, you will be able to:

- Master accounting fundamentals, including double-entry bookkeeping, ledgers, journals, and transaction recording

- Analyze financial statements like income statements, balance sheets, and cash flow statements to assess company performance

- Calculate and interpret financial ratios to evaluate profitability, liquidity, efficiency, and solvency

- Create operational and capital budgets that help organizations plan resources and control costs

- Forecast revenues, expenses, and cash flows using proven techniques that predict future financial performance

Our Students Rate This Course

Trainer

Program Fee

Rs 1,55,000 + GST

Available Seats

100

Schedule

1 Live Class per Week (6 Months - 24 Weeks) Plus 2 Practical Exercises Weekly

Only Few Seats Left

Reviews

Testimonials

NEWS & UPDATES

Career Transitions

55% Average Salary Hike

$1,27,000 Highest Salary

800+ Career Transitions

300+ Hiring Partners

Who Can Apply for the Course?

- Fresh Graduates and Students: Perfect for B.Com, BBA, MBA students, or recent graduates looking to build job-ready skills that go far beyond college textbooks. Gain practical expertise that makes you immediately employable.

- Working Professionals: Finance executives, accountants, and business analysts who want to upgrade their analytical capabilities and become strategic decision-makers rather than just data processors.

- Career Switchers: Engineers, IT professionals, or anyone from non-finance backgrounds looking to transition into high-growth finance and analytics roles. We'll teach you from the ground up.

- Aspiring Entrepreneurs: Business owners who need to understand their financial health, create budgets, forecast cash flows, and make informed investment decisions to scale their ventures.

- Investment Enthusiasts: Anyone interested in understanding how professional investors analyze portfolios, assess risks, and build diversified investment strategies using modern financial theory.

About Program

At iHUB DivyaSampark, we are driven by the belief that young, innovative minds have immense potential to transform the world. Our core mission is to develop highly knowledgeable human resources with top-order, industry-relevant skills.

Whether you are looking for a career transition, a significant salary hike, or to master specialized knowledge, our programs provide the mentorship and practical exposure needed to achieve successful career outcomes and help you secure roles with our network of 300+ hiring partners

Key Highlights

Our Alumni Work At

What is included in this course?

- Non-biased career guidance

- Counselling based on your skills and preference

- No repetitive calls, only as per convenience

- Rigorous curriculum designed by industry experts

- Complete this program while you work

I’m Interested in This Program

Courses

Other Courses You Might Be Interested In

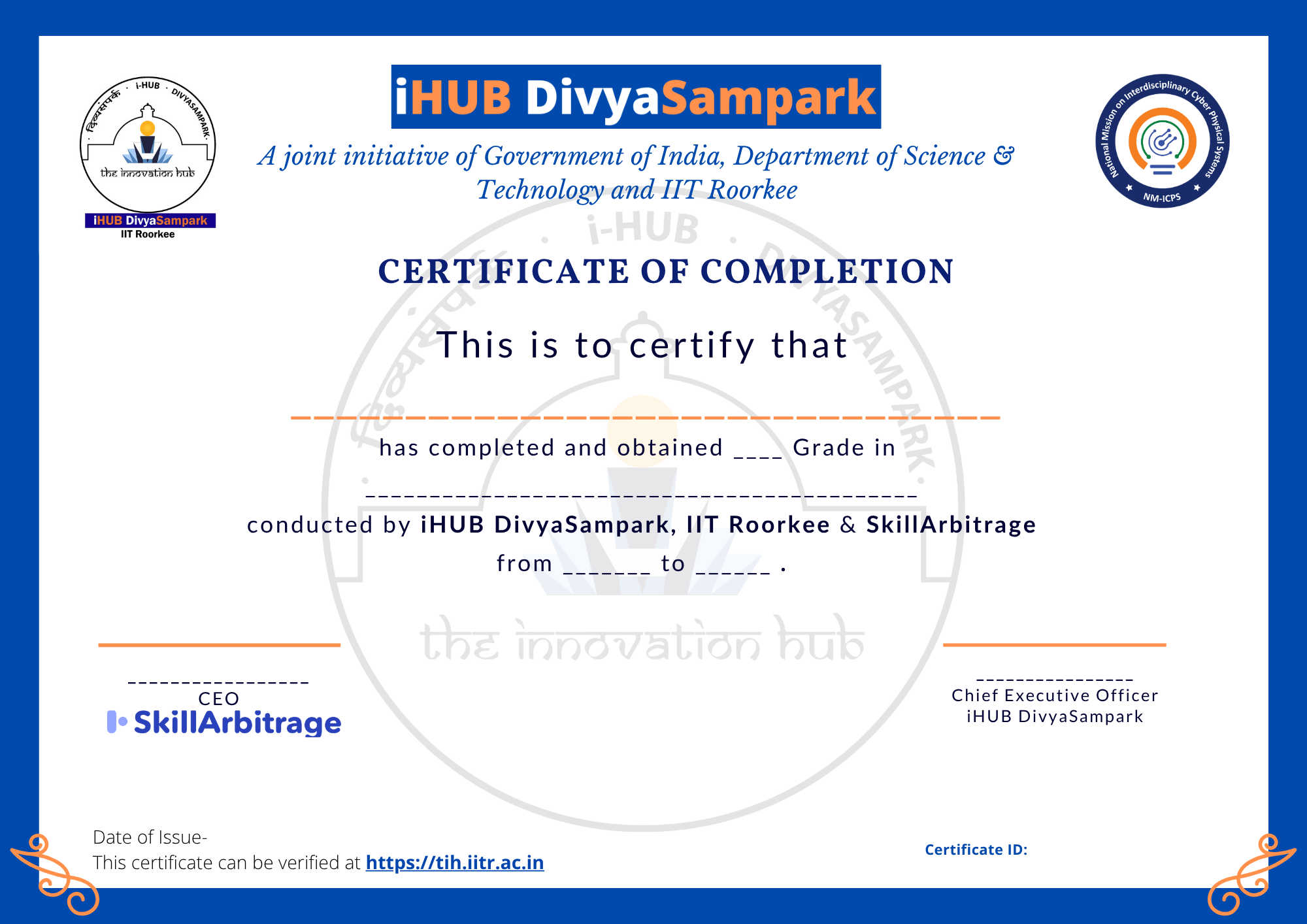

Certificate

Rs. 65,000 + GST/-

Advanced Certification in Data Science and AI

Learn Data Science and AI from IIT Faculty with Campus Immersion @ IIT Roorkee

Certificate

Rs. ₹60,000 + GST*/-

Future-Ready Product Management with Applied AI Program

6 Months | 4-5 hours per week

MASAI

MASAI

Certificate

Rs. 2,00,000 + GST/-

Executive Post Graduate Certification in VLSI SoC Design and Verification

12 Months

MAVEN silicon

MAVEN silicon